A definition of business agility concerns the organization's ability to adapt, change quickly, and renew itself in a volatile market environment. It is about the capability to adjust strategy, sometimes radically, testing the results they go. It is about altering the organization, adapting or inventing new processes, and for some, the absorption of modern technology.

Yet an organization rarely has the capability, capacity, budgets, or resources to pursue at a pace all activities on its' agenda. The consequence is that judgments regarding which actions to initiate and which to delay are required. In change management terms, this decision-making process is known as portfolio management.

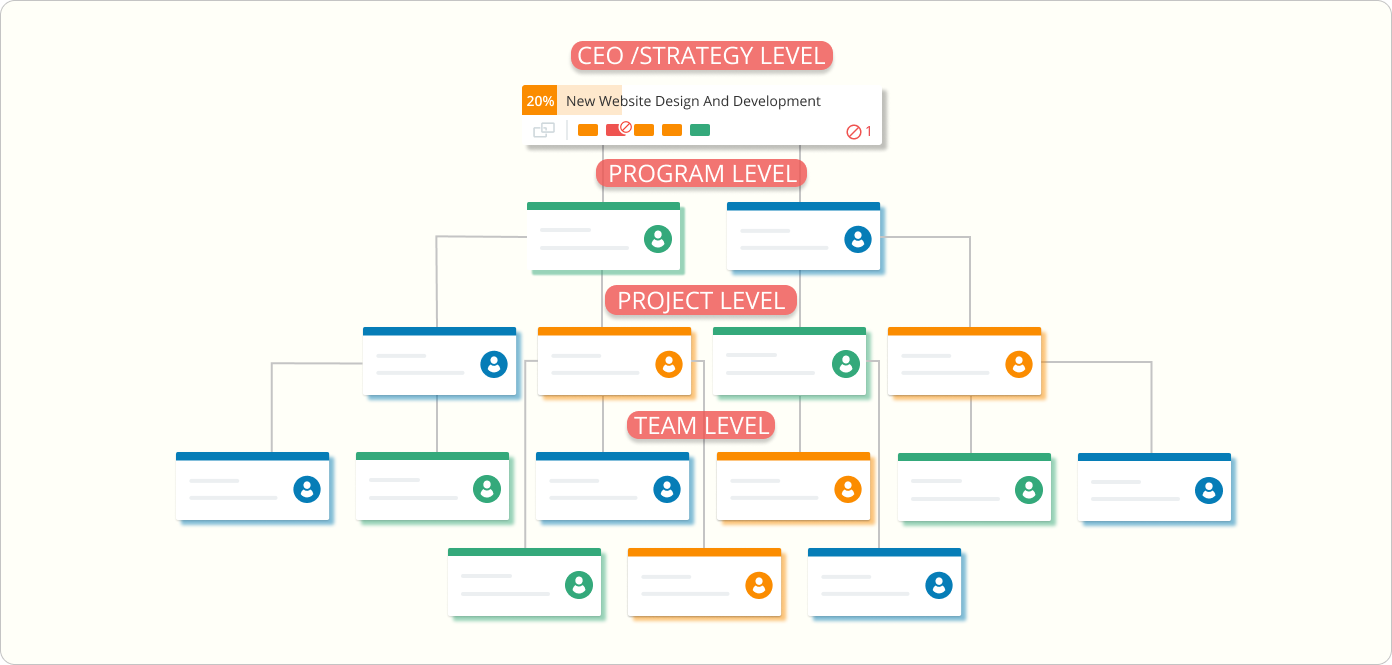

Think of portfolio management as the pre and post-investment decision-making. Modern portfolio management has migrated from textual reports and complicated spreadsheets to visualization using Kanban techniques supported by analytics producing portfolio KPIs and recommendations.

Portfolio management allows organizations to identify, prioritize, and execute the initiatives which optimize the gain in terms of strategic opportunities enabled. It also gives clarity when activities will not deliver the anticipated benefits or when further investment in a product or activities will no longer provide the desired outcomes.

Analytics are used to identify potential investments with falling returns or unfunded activities, which can present a more significant strategic gain than some in-flight activities. Agile Portfolio management is, therefore, as much about stopping or re-prioritizing activities as it is about starting them.

Drivers for Change

Typically, organizations have three competing input drivers for investment. The first input is the strategic plans. In strategic planning, the process options are identified. Options are then broken down into prioritized and actionable work items.

The second is the market requirements, regulatory changes, responding to competitor's actions, and so on. The third source of work required is the myriad of small changes needed for efficiency or productivity improvement under the banner of continuous improvement.

In an ideal world, a portfolio plan should provide a line of sight from the creation of the vision to the achievement of the strategic aim. However, this is rarely the case. Organizational priorities change. The anticipated benefits from plans set out months, sometimes years in advance, may be reduced by changing market conditions or competitor activity.

Assumptions made at the time of business case creation may be found to be invalid. Organizations in volatile markets will need to validate and revise their portfolio plans more often than those in more stable environments.

Some market requirements can be predicted well in advance, while others simply cannot. In these instances, the portfolio planners need to make decisions to re-prioritize the portfolio activities so that they can accommodate more urgent market-driven requirements.

Lastly, some small changes may be enablers of some items that have significant benefits or strategic gains. The portfolio management process, therefore, must be capable of linking activities together, much like a value chain, so that these enablers have the appropriate level of visibility.

Timing

While the focus of portfolio planning is on the creation of value and ensuring that the business-critical activities are clearly understood, there is always the question of timing. Unfortunately, organizations do not have infinite capacity or infinite budgets.

The portfolio management process must, therefore, look at the schedule and consider the organizational constraints. These timings, of course, need to be related to the desired outcomes while using Lean techniques to limit the work in progress at any one time to increase flow and throughput.

Activity Life Cycles

Portfolio management is made more complicated by the range of life cycles of the activities. For example, a strategic initiative may go through a formalization stage using design thinking, followed by a prototyping stage using a lean start-up approach, followed by an agile project that will deliver the proven prototype in production volumes.

On the other hand, a market-driven initiative almost invariably has a lifecycle, which is exclusively the agile project lifecycle. Small changes may use a Kanban-based release management approach.

A Portfolio Kanban will allow the configuration of several different workflows to cater to the differences in approach for the various activities.

As the activities become more transparent and are broken down into features, the teams will create entries on related Kanban boards, which can automatically update the status of the parent portfolio Kanban.

Benefits mapping techniques can be used to distribute organizational benefits across the features. These techniques allow teams to prioritize the sequence of the solution delivery subject to dependencies and critical constraints.

Rolling Wave Portfolio

As stated earlier, organizations that operate in a volatile market need to review their portfolios almost continually. Most organizations use a technique known as rolling wave planning when the portfolio is refined and the portfolio backlog cleansed every quarter, known as rolling wave portfolio planning.

The basic idea with rolling wave portfolio planning is that you plan things that are closer in time to now in detail and things that are distant in time at a higher level. There is a constant review of the priorities in work awaiting to start and those activities in-flight.

The thinking is that the further away in time that something is, the higher the chance that it will change during that time. Therefore any time or resources used in thinking through the details of items on the longer-term agenda may be wasted.

A plan is still required at a high level to guide your current decisions and to set people's expectations as to what is likely in the future. However, detailed planning to the point where the activity can start is delayed until we get closer to activity initiation.

It is correct that agile delivery practices give more opportunities to close out delivery activities than many traditional approaches. As one investment banker told me recently, "this organization is great at kicking off projects but very bad at stopping them." In rolling wave planning, the organization checks that it is maximizing the opportunity from its strategic investments on a very regular basis, often monthly. Rolling wave planning can make use of a portfolio Kanban showing a prioritized backlog, the activities that are in-flight, and those activities that are completed and delivering results. Benefits management principles suggest that collecting the benefits data helps the organization make better investment decisions over the medium term. Collecting this data also ensures that the focus remains on the organizational value delivered.

Tracking the Benefits

Measuring realized benefits in a reasonably dynamic organization is tricky. Over time the ability to economically collect realistic benefits data erodes. The accuracy of data captured degrades almost on a logarithmic scale. As more change lands or market conditions alter, so the ability to trace an improvement to a particular initiative fades.

Never-the-less in the portfolio reporting, those who make the investment decisions wish to see business benefit figures alongside the investment numbers. Enabling future investment management based on recent trends is a crucial goal for many enterprises.

We have found that investments with a more than nine-month payback period will be reported as a trend rather than as an accurate number. So, organizations take the approach that, once approved, figures established in a business case are reflected in operational budgets and revenue plans in line with the business case assumptions.

The consequence of enhancing value management within the agile delivery and implementing benefits tracking in agile portfolio management is that the quality of the data in business cases dramatically improves. We have found that teams and sponsors work collaboratively, defining the scope of initiatives in previously unheard-of ways that maximize the value created from investment.

Portfolio reporting using analytics on the product delivery and the benefits derived increased the organizational focus on strategic gains and timelines in ways that increase organizational agility.

Conclusion

Agile portfolio management emphasizes organizational value delivered. Portfolio Management focuses on making investments in the activities that produce the highest corporate return. The portfolio process also encourages those making the decisions and the teams delivering the solutions to consider the viability of the iterative activity.

Portfolio Kanban has best practices on which senior management can rely. Regularly checking the viability of each investment encourages teams to maximize and clearly illustrate the organizational value delivered or anticipated. In doing this, it strengthens the link between the work undertaken and the strategic plans.

It is this continual verification of the change investment portfolio that provides the organizational agility, the ability to start activities, and to stop activities if something appears that has a higher strategic priority.

Jon Ward

Guest Author

Jon Ward has worked in Change Management for over thirty years. He believes in contextual agile. Rather than using one framework or set of techniques, Jon introduces appropriate ways of agile working, enabling organizations to achieve their strategic goals. Currently, as CEO for Beneficial Consulting, Jon is focused on the cultural and transformational aspects of implementing agile.

![Fundamentals of Portfolio Kanban [Infographic]](https://sandbox.businessmap.io/images/uploads/2017/09/portfolio-kanban-infographic.png)